How Accountants Can Use AI Accounting Without Being Techy

No accountant wants to train AI and ML models. Yet, AI in accounting can’t be ignored. Learn how to use accounting AI without being technical.

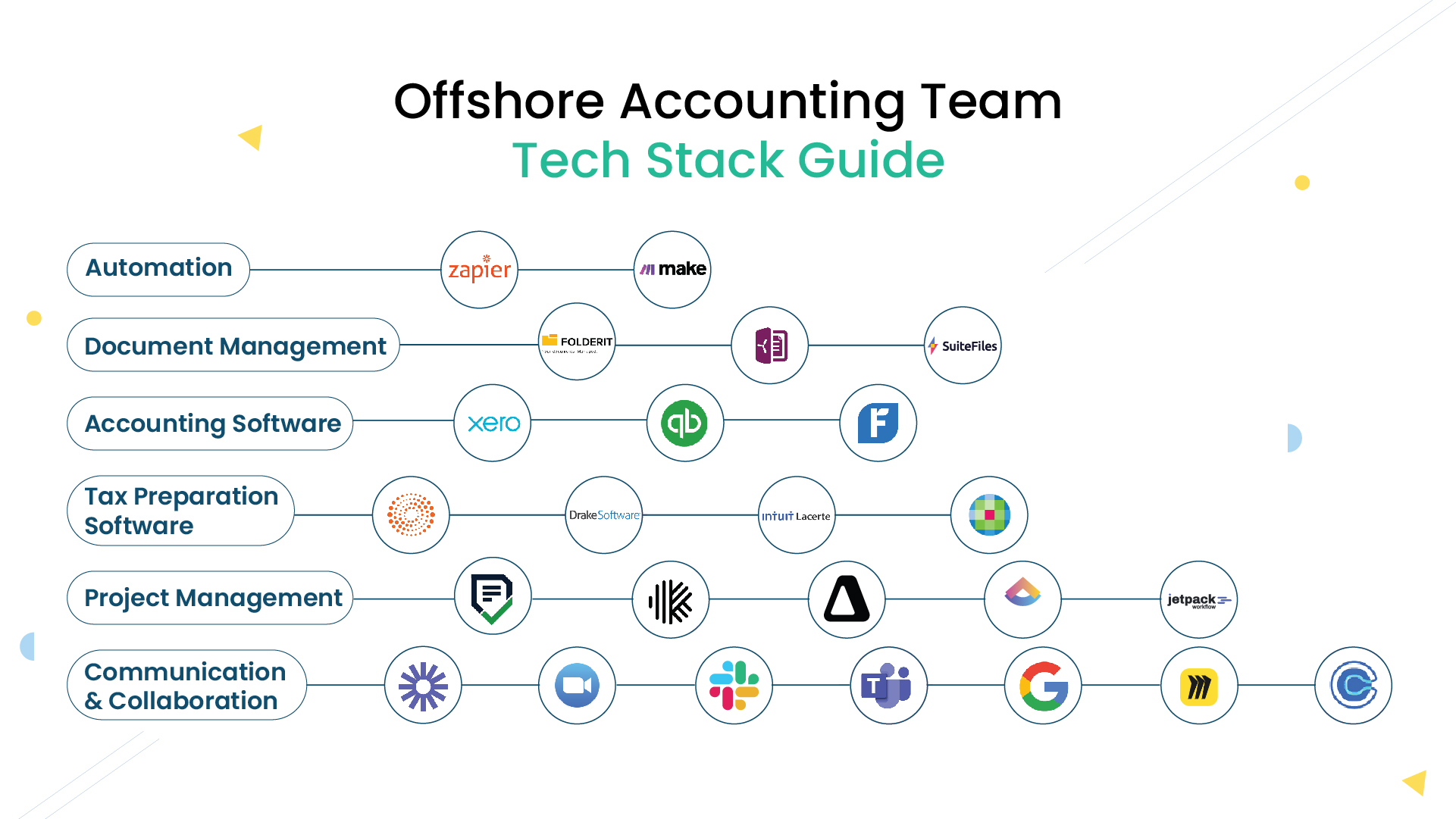

Working with remote or offshore accounting teams brings unique challenges, but modern times have tools for accounting firms to overcome them. In this blog, we will discuss top accounting software that you should know about to run your remote team smoothly.

Recent global events have changed how we work. Working from home is now the norm, making offshore accounting even more attractive.

To work remotely, you need better communication, collaboration, and document security. This is the first step for accounting firms looking to offshore accounting or build a remote team – get clarity on their tech stack.

The market is flooded with accounting software, especially since the pandemic. Many tools claim to be one-stop solutions for all your collaboration needs. Choosing the right tech stack saves time and money, advances digital accounting, and improves internal workflows.

You don’t need to research every tool available because I’ve done it for you. Here are the top 24 tools for accounting firms to run your remote operations effectively.

Zoom is one of the top collaboration tools for remote accounting teams. It lets you talk virtually to your team face-to-face, no matter where you are in the world.

Use Zoom for client meetings and team building to keep everyone connected despite the distance. The great thing about Zoom is that the links are shareable, and to have a meeting you just need to share the link. Unlike Teams, the person you are inviting for a video call doesn’t need to be a part of your team which makes it the right choice for client calls. This virtual tool keeps your accounting team on the same page, boosts efficiency, and ensures secure communication.

If you need to give instructions or explain a standard process to your offshore accounting team, you usually write a long email or schedule a meeting. Loom eliminates the need for both with an alternative that gets the job done smarter.

Instead of lengthy emails explaining complex accounting tasks or new software features, accountants can record screencasts with voiceovers. This visually guides remote teams step-by-step, saving time and ensuring everyone is on the same page. It’s like having a mini video library for your offshore team to access anytime.

The unique way has made Loom a trending collaboration tool for remote teams. Accountants can easily record videos showing how to use accounting software or explain standard processes for their offshore team to follow.

Your offshore accounting team wants to connect for a face-to-face meeting. First, they email you to ask about your availability. Then, you check your schedule and reply. It’s a lot of hassle just to schedule a meeting. And the solution is straightforward, making Calendly one of the must-have collaboration tools for remote teams.

Calendly makes collaboration easier. Remote accounting firms use Calendly to check open meeting slots and book a slot that suits both parties. This streamlines scheduling, improves communication, and keeps offshore accounting teams engaged by giving them more control over their schedules.

When you work in an office, you use a whiteboard for strategic meetings and brainstorming sessions. Miro is that whiteboard, but virtual. Offshore accounting teams can share ideas, create flowcharts of complex processes, and collaborate in real-time. Miro makes it easy for your team to brainstorm and plan together, no matter where they are.

If you have ever felt that you are not able to brainstorm at its best with your remote accounting firm, give a shot to Miro. It will become one of your favorite tools for accounting firm.

Slack is a communication app, but it offers much more with its wide variety of API integrations which makes it one of the most amazing collaboration tools for remote teams. Let me explain. Slack notifies you of every single activity if you integrate it with your platform. So, if you want to stay up-to-date at lightning speed, use Slack.

Here’s an example: Accounting workflows can become much more efficient with Slack integrations. When a new client record is created in your accounting software, Slack can trigger a flow to streamline onboarding. This flow automatically creates a dedicated Slack channel named after the client (e.g., #clientname_2024). This channel centralizes communication and documents, making it easy to keep everything organized. It also sends a welcome message introducing the team and outlining the next steps. This ensures a smooth and organized client experience from the very beginning.

Offshore accounting teams can use Microsoft Teams to chat, share files, and video chat with colleagues or clients. It allows you to work together on documents like tax returns, assign tasks, and track deadlines all in one place.

For clients, Teams provides secure access to submit documents on One Drive and stay informed about their progress. This tool streamlines collaboration, keeping everyone on the same page and ensures that tasks and deadlines are managed efficiently.

Google Workspace is a collection of Google tools perfect for small remote accounting firms not looking for a complex collaboration tool:

The tool enhances communication, collaboration, and organization, making it easier to manage your workload and keep your team coordinated.

On the surface, communication tools like Slack, Teams, and G Suite may seem similar, but there are key differences that set them apart. Understanding these differences is crucial when choosing tools for accounting firm.

Feature | Slack | Teams | G Suite |

Primary Function | Communication & Collaboration Platform | All-in-One Collaboration Suite | Cloud-Based Productivity & File Sharing |

Strengths | * User-friendly interface * Integrations with many tools * Strong for informal communication & team building | * Integrates seamlessly with Office 365 * Strong file sharing & co-authoring features * Built-in video conferencing & calling | * Secure cloud storage * Excellent document editing & creation tools * Familiar interface for Gmail users |

Weaknesses | * Limited file sharing & co-authoring capabilities * Can become cluttered with many channels & integrations * Lacks built-in video conferencing | * May require additional licensing for advanced features * Less customizable interface compared to Slack * Tighter integration with Office 365 products | * Limited communication features compared to Slack & Teams * Not ideal for real-time collaboration |

Ideal For | * Teams looking for a communication hub with integrations * Remote teams & project-based work * Companies with a casual work culture | * Businesses using Office 365 heavily * Teams needing strong file collaboration & video conferencing | * Businesses & individuals needing secure cloud storage & document editing |

Pricing | Freemium (limited features), Paid plans based on users | Freemium (limited features), Paid plans based on users & storage | Free (limited storage), Paid plans based on storage & features |

SuiteFiles is a digital workspace designed specifically for accounting firms. It centralizes all client documents, financial records, tax returns, and internal files, ensuring secure and organized storage. When working in remote setting, DMS such as SuiteFiles become a one of must have tools for accounting firms.

Key Features:

FolderIt is a document management system (DMS) specialized for accountants and professional service firms. It helps accounting firms manage documents efficiently and securely. While offshoring accounting, you share data with your extended team and having a secure platform lets you manage your accounting firm operations efficiently.

Key Features for Accountants:

SmartVault is a tool designed to enhance document management for accounting firms. It streamlines processes, improves security, and boosts client collaboration. Here are its key features:

Financial Cents is an accounting practice management software designed to eliminate the chaos of spreadsheets and sticky notes. Unlike generic project management tools, Financial Cents caters specifically to accounting firms, offering features that streamline workflows and boost communication.

Here’s what sets Financial Cents apart:

Centralized Hub: Manage everything from client tasks and internal communication to time tracking and files – all in one platform.

Client Collaboration: Automate client data collection, share files securely, and assign tasks through a dedicated client portal.

Focus on Efficiency: Free your team from repetitive tasks with automation features and gain real-time project insights through the workflow dashboard.

Financial Cents offers a 14-day free trial, so you can experience the difference it can make in your accounting practice.

Just like Financial Cents, Karbon is an advanced work and communication platform designed specifically for accounting and professional services firms. It helps them deliver high-quality services through efficient planning, communication, and team collaboration.

Here are Karbon’s key features:

Karbon also offers a 14-day free trial.

Canopy is an all-in-one practice management system for accountants. Streamline workflows with bulk actions, AI-powered emails, and role-based task templates. Impress clients with a secure mobile portal for documents, e-signatures, and payments. Gain data-driven insights to optimize your firm’s efficiency.

Canopy’s key features:

Canopy gives a 15-day free trial,

Jetpack Workflow focuses on simplifying task and deadline management for accounting firms, especially smaller ones.

Key Features:

At its core, Jetpack Workflow is a workflow management platform and doesn’t provide buil-in invoicing feature.

Jetpack Workflow also offers a 14-day free trial.

Clickup is not particularly built for accountants but a good workflow management tool and cost effective too. ClickUp can be a helpful tool for your accounting practice, but it might not be a perfect replacement for dedicated accounting software.

Key Features:

ClickUp gives a Freemium plan.

Zapier is a powerful automation tool that connects different apps to streamline tasks for accounting firms. It helps automate repetitive processes, making your workflow more efficient.

Key features for accounting firms include:

Make is a powerful tool for accounting firms that goes beyond traditional no-code workflow automation. Unlike linear and non-intuitive platforms, Make allows you to visually create, build, and automate complex tasks without limits.

Key Features:

Quickbooks is known for its detailed and extensive feature set, which can be complex for beginners but is highly valued by professionals

Key Points:

Freshbooks is considered the most user-friendly for sole proprietors or small teams. It simplifies invoicing, time tracking, and project management, making it easy to manage finances without extensive accounting knowledge.

Key Points:

Xero is for its clean, user-friendly interface and ease of use. However, it has a learning curve like QuickBooks when using more advanced features.

Key Features:

Lacerte is a versatile tax software designed for all types of tax practices, excelling particularly in handling complex tax returns. It’s well-suited for accounting firms seeking comprehensive tax solutions.

Key Features:

UltraTax CS is designed for accounting firms focusing on automation and high efficiency, making it suitable for handling a variety of client types including individuals and corporations.

Key Features:

Drake is a comprehensive tax software suitable for a variety of tax practices, from small to large firms. It’s known for its continuous innovation and cost-effectiveness.

Key Features:

CCH ProSystem fx Tax is best suited for mid-size to large and international accounting firms that handle a high volume of complex returns.

Key Features:

Ensuring successful collaboration with offshore teams is crucial for any accounting firm. Here are five essential steps to make this process smoother and more effective:

To simplify communication and keep everyone on the same page, use a common collaboration tool. A single platform for messaging, video calls, and project updates can significantly boost team synergy. Excellent tools include Zoom, Slack, Teams, and G Suite. These collaboration tools help maintain clear and consistent communication, fundamental for effective teamwork.

When everyone follows the same processes, it reduces confusion and increases efficiency. Clear guidelines and standardized procedures are crucial for smooth operations. Establishing and enforcing standard operating procedures ensures all team members, whether onshore or offshore, are aligned and working cohesively. This uniformity helps maintain consistency in quality and productivity.

Effective communication is the backbone of successful offshore collaboration. Over-investing in communication means making a conscious effort to communicate more frequently and clearly than you might think is necessary. Regular check-ins, detailed updates, and transparent sharing of information can prevent misunderstandings and keep the entire team aligned with the project’s goals. Tools like Loom, Calendly, and Miro can facilitate enhanced communication.

Secure document sharing protects sensitive information and ensures compliance with data protection regulations. It’s crucial for maintaining trust and integrity within the team. Using reliable document management tools like SuiteFiles, FolderIt, and Smart Vault can help in securely sharing documents. These tools ensure all team members have access to the latest versions of important documents while keeping data protected.

The right project management software helps manage projects effectively, track progress, and meet deadlines. It should be robust enough to handle the complexity of your projects and intuitive for all users. For accounting firms, some recommended tools include Financial Cents, Karbon, Canopy, Jetpack Workflow, and ClickUp. These project management tools are designed to streamline workflows and enhance productivity.

By using the right tools and processes, you can ensure that your team works seamlessly together, no matter where they are located.

Building a vast tech stack can seem overwhelming. Having the right tools at place can enhance productivity but also adding the wrong and unnecessary tools can over complicate things.

While picking out tools for your accounting firm, consider your requirements and scale of operations. Pick what streamlines operations and make collaboration easy.

To collaborate with an offshore accounting team, follow these tips –

To track the productivity and performance of remote accounting staff, start by assigning clear key performance indicators (KPIs) for each team member. Utilize project management tools such as Karbon, where you can assign tasks and keep track of progress effectively. For a simpler solution, consider using Jetpack Workflow, a straightforward practice management software designed for accounting firms. These tools help ensure that tasks are completed on time and that team members stay productive and accountable.

To manage remote accounting teams effectively, you need a basic tech stack including key tools: a project management platform like Karbon or Jetpack Workflow to assign tasks and track progress, communication tools like Zoom or Slack for seamless team interactions, document management tools like SuiteFiles for secure file sharing, and accounting software like QuickBooks for streamlined financial processes.

To streamline communication between onshore and offshore accounting staff:

Foster Cultural Exchange: Share cultural experiences to strengthen bonds and foster respect.

Utilize Effective Tools: Use collaboration tools for remote teams, such as:

Personalize Management: Adapt your management style to fit the cultural and individual preferences of your offshore team.

Namrata Jain is a Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations. She's an Enrolled Agent (EA) and Chartered Accountant (CA) and brings over 12 years of experience in accounting and taxation.

Namrata Jain is an Enrolled Agent (EA), Chartered Accountant (CA), and Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations.

No accountant wants to train AI and ML models. Yet, AI in accounting can’t be ignored. Learn how to use accounting AI without being technical.

You’ll see exactly what “Accounting AI” looks like in practice. We’ve structured it as a simple list of the 9 smartest ways firms like yours can use AI in accounting.

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside