22 Accounting Social Media Posts for Firms (That Aren’t Boring)

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Just as people once believed the Earth was flat, many accounting firms today have certain “perceived truth” about offshore accounting that can limit their growth and profitability. These myths, like ancient misconceptions, create barriers to exploration and innovation in your practice.

Offshore accounting is a powerful strategy to scale your firm, address talent shortages, and boost profit margins for growth activities. Yet, it remains one of the most misunderstood approaches in the industry.

I have seen firm owners often saying they’ll never offshore again due to a bad experience. But as Ryan Lazanis puts it, 9 times out of 10, the issue stems from selecting the wrong person or failing to provide proper training.

I regularly speak with accounting firm owners, and the misconceptions about building an offshore team with virtual accountants run deep. Amid an ongoing talent crunch, firms struggle to find the right candidates domestically but hesitate to offshore—even when offshore talent is readily available. Why? Because offshoring has earned an undeserved bad reputation.

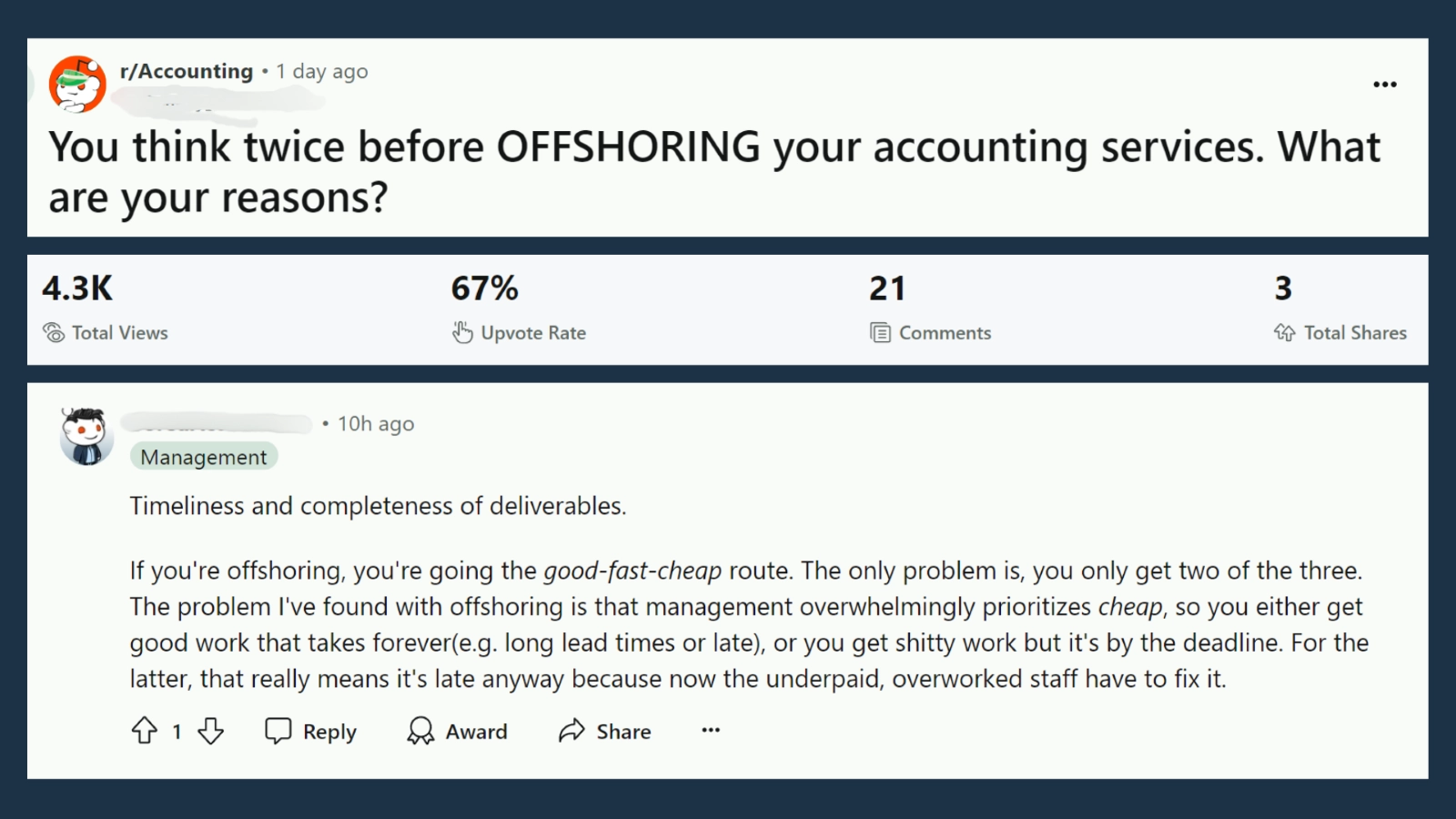

In fact, I recently posted on Reddit about common reasons why offshore accounting gets a bad rap. The post garnered over 4,300 impressions and 21 comments, highlighting just how pervasive these misunderstandings are.

Accounting outsourcing and offshoring are often used interchangeably, but they’re not the same. Outsourced accounting is more of a black-box approach, where you hand over everything to a third party, with little visibility in the process.

Offshore accounting, however, involves hiring full-time employees in another country or partnering with a skilled team abroad. The key difference? With offshore accounting staffing model, you maintain direct communication and control with the employees working on your project, ensuring quality and accountability.

Offshore accounting and outsourced accounting differ significantly in several key areas—staff retention, client communication, data security, and the onboarding learning curve, to name a few. I’ve written a detailed blog on Offshore vs. Outsourcing that offers a clearer understanding of these differences.

Related Read – 4 Staffing Models That Accountants are Using for Offshore Accounting

Many people quickly equate price with quality—it’s a mental shortcut that leads consumers to assume higher prices mean better products or services. This is why premium brands often carry a high-end image.

To some extent, this thinking holds true when outsourcing accounting as well—top talent does command top dollar. If I want an expert tax reviewer on my team, I’m prepared to pay for that expertise. However, due to currency differences, that same expert might seem like a bargain when hired offshore.

For a fair comparison, consider Purchasing Power Parity (PPP). While a U.S. bookkeeper earns a higher salary, PPP suggests that a bookkeeper’s salary in India can offer a similar standard of living.

Another common concern is the discomfort with what seems like low wages. You’re compensating an Indian bookkeeper or accountant at a rate comparable to their U.S. counterpart, but currency differences work in your favor.

Being an accountant, I love to compare costs and did a post on PPP as well. Check it out.

To truly appreciate the value, it’s important to shift your perspective on pricing.

Time zone differences can indeed pose challenges, but the notion that they will inevitably derail a project is a misconception. Online accounting has made it possible to work seamlessly from virtually anywhere. Think back to how we all adapted during COVID, working from home at our convenience.

We discovered tools and strategies that made remote work successful, such as:

These methods help overcome communication challenges across different time zones. And let’s not forget the significant advantages—like offering round-the-clock service, which many of our clients truly appreciate.

For example, Mr. Johnson, a small business owner in New York, received a tax notice late in the evening disputing over $15,000 in claimed business expense deductions. His CPA, our client, was at capacity and needed help. He turned to our team to quickly resolve the issue without disrupting his workflow.

While some firms see time zone differences as a disadvantage, our CPA client found it to be an asset.

Language barriers are often cited as a concern with offshoring, but this perception is increasingly outdated. Countries like the Philippines and India have become top choices for offshore accounting, and the language landscape has evolved significantly.

Speaking from my own experience in India, the shift has been remarkable. Consider these stats:

These numbers demonstrate that language is less of a barrier than many believe, especially when partnering with offshore teams from these regions.

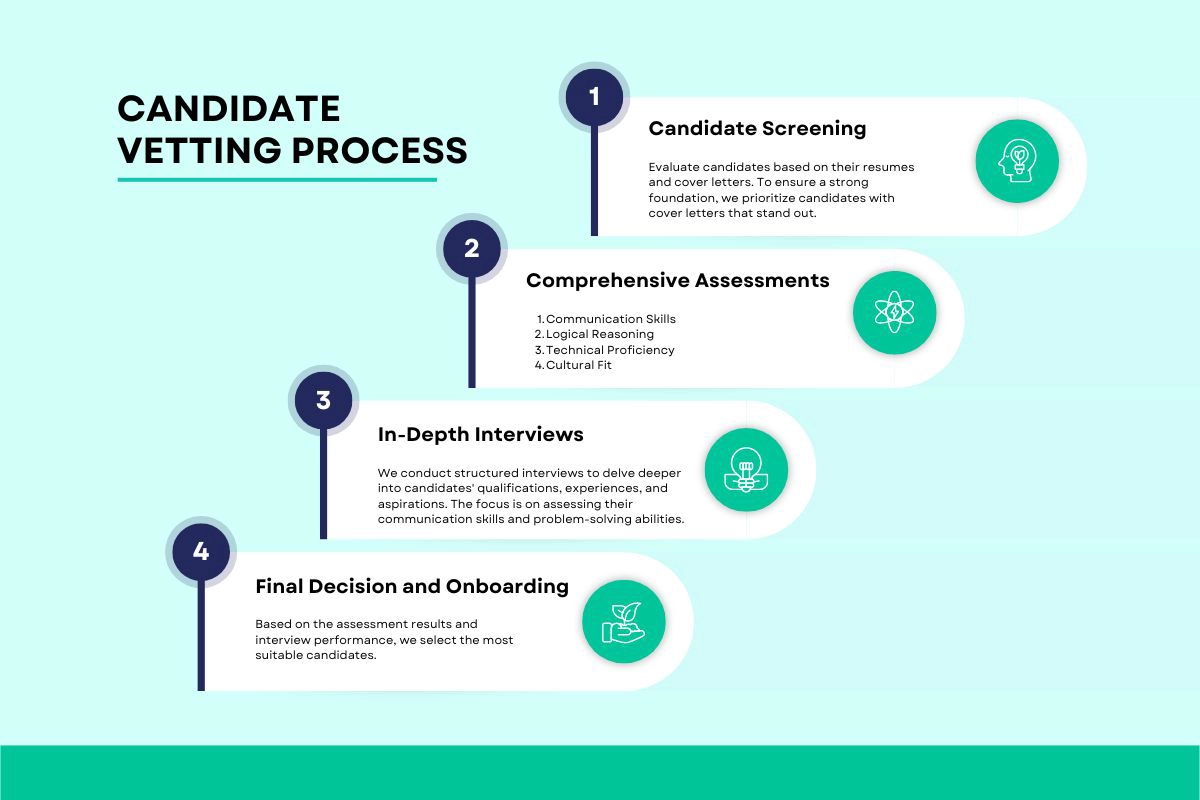

At Credfino, we place a strong emphasis on communication skills during our hiring process. Our thorough vetting process includes rigorous evaluations of communication abilities, logical reasoning, technical expertise, and cultural fit. This ensures that every team member we bring on board is not only highly skilled but also an excellent communicator

The “black box” approach to outsourcing has often left accountants frustrated, as they find themselves fixing errors made by “cost-effective” offshore accounting staff rather than getting the relief they expected. Inconsistent processes and fluctuating work quality, due to staff changes from project to project, have made it hard to hold anyone accountable for subpar performance. This has understandably led to hesitation when considering outsourcing.

However, by prioritizing clear communication, partnering with a reliable offshore provider, and bringing top talent onto your team, your in-house staff will begin to see the true value in offshoring. A professional staffing partner assigns a dedicated team member to your account, ensuring consistency and accountability in the work being done.

This approach makes quality control not only possible but effective. With a dependable offshore team efficiently handling backend tasks, your onsite staff can focus on more complex, client-facing work—providing the support they need to thrive.

Accounting firms need to focus on their security infrastructure regardless of whether they plan to offshore. With online accounting, data is accessible not just to employees but also to hackers. That’s why it’s crucial for accounting firms to have a robust system in place to ensure data safety.

Accounting Staffing partners are equally responsible for ensuring data safety. At Credfino, we use Virtual Desktop Infrastructure (VDI) and Remote Desktop Protocol (RDP) to create a secure virtual office environment. These technologies allow offshore employees to work as if they were physically in the U.S., without compromising data security. Sensitive financial data stays within the U.S. company’s secure network.

Here’s how it benefits you:

Offshore teams are more than capable of handling complex work. In fact, many offshore professionals hold advanced certifications and have experience working with global standards.

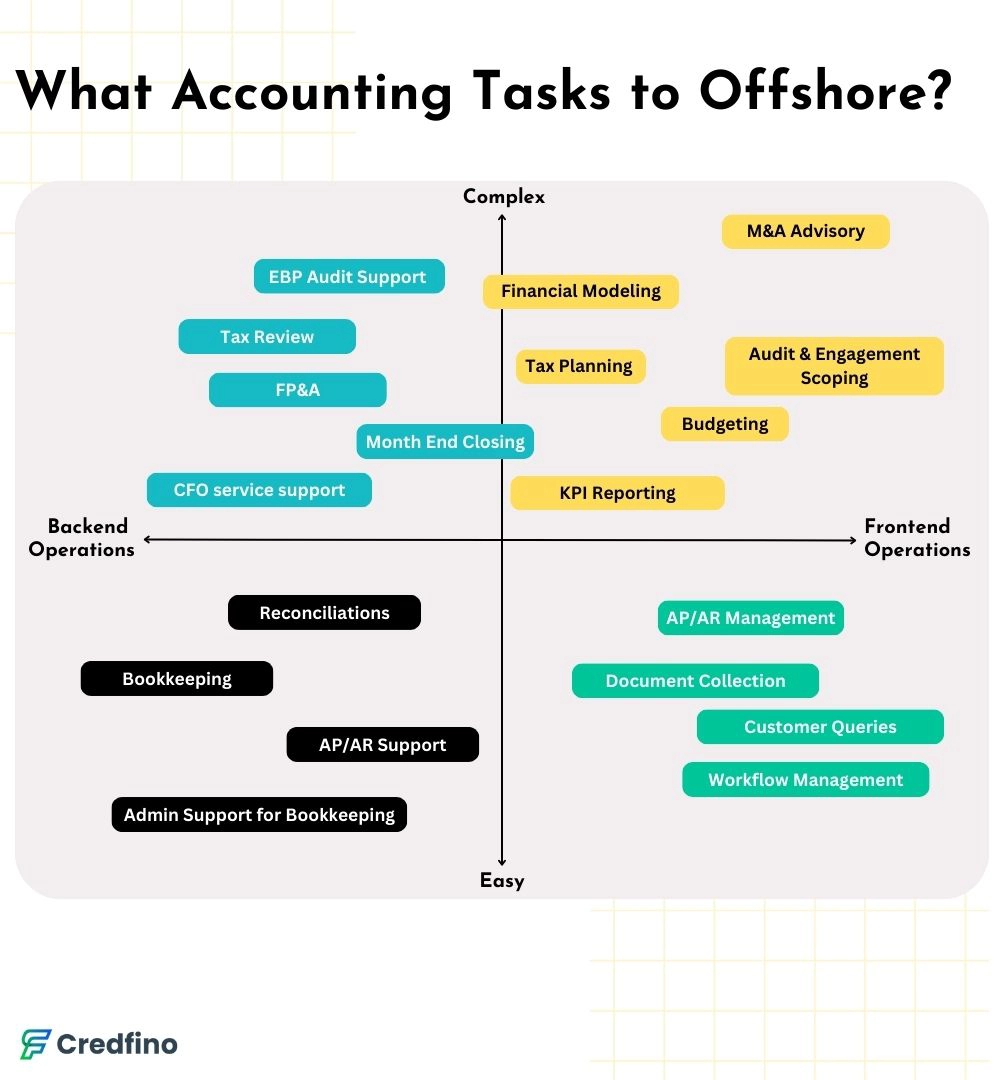

I’ve developed a customized Eisenhower Matrix specifically for offshore accounting services:

Easy + Backend = Offshore

Complex + Backend = Offshore (hire senior staff)

Easy + Frontend = Offshore (evaluate communication skills + experience)

Complex + Frontend = Keep Onsite

You’ll notice that even complex backend tasks are assigned to the offshore team. That’s because offshore teams—especially accountants in India—are more than capable of tackling complex work. And I’ve got the numbers to back it up.

As of July 2024, India boasts over 400,000 chartered accountants, a credential as rigorous as a CPA. I hold both the Enrolled Agent and CA titles, and I can assure you, neither was easy to earn.

The Big 4 firms—Deloitte, PwC, EY, and KPMG—are increasingly hiring Indian graduates, which speaks volumes about their capabilities. Having worked with accountants from various countries, I can confidently say that Indian accountants are just as skilled. However, as with any hiring, it’s crucial to vet candidates carefully. Look for the right certifications and strong problem-solving skills.

At Credfino, we don’t take this lightly. Our staff is trained in US GAAP and IFRS, with EA/CPA qualifications. We prioritize rigorous training to ensure our team is well-equipped to handle complex tasks efficiently.

How your clients perceive offshoring is heavily influenced by how you present it. While cost savings are a significant benefit, clients often have mixed emotions and practical concerns. Here’s what might be on their minds:

Common Client Concerns:

How to Build Trust:

Success stories from initial pilot projects can help persuade others. Don’t just focus on cost savings—position offshoring as a way to improve turnaround times, address talent shortages, and access specialized accounting expertise.

Employee turnover happens everywhere, not just offshore. By partnering with a staffing provider that invests in employee satisfaction and growth, you can minimize turnover and avoid the constant need for retraining. SOPs and clear processes also help ensure continuity.

Offshore accounting has evolved beyond just cost savings—it’s about scalability and growth. By debunking these myths, you can unlock the full potential of offshore teams and propel your firm to new heights.

At Credfino, we’ve helped over 80 CPAs and accounting firms overcome these challenges and thrive. If you’re ready to explore how offshoring can support your firm’s growth, schedule a call with us today. Let’s take the first step together.

Accounting firms, whether outsourcing or not, must prioritize data security. Online operations expose sensitive financial data to potential threats. Implementing robust security measures, like VDI and RDP, is crucial to protect client information. These technologies create a secure virtual environment, preventing unauthorized access and data breaches.

By safeguarding sensitive data, accounting firms can maintain client trust and comply with stringent data privacy regulations.

Establish Clear Channels: Use a combination of tools like email, instant messaging, video conferencing, and project management software for seamless interaction.

Regular Communication: Schedule regular meetings or check-ins to discuss project progress, challenges, and expectations.

Overcome Language Barriers: Utilize clear and concise language, avoid jargon, and consider language training for team members.

Cultural Sensitivity: Understand and respect cultural differences to build rapport and trust.

Documentation: Maintain clear and detailed documentation of processes, decisions, and agreements.

Feedback Mechanisms: Encourage open feedback and provide constructive criticism.

Build Relationships: Foster a collaborative environment through virtual team-building activities and informal interactions.

These methods help overcome communication challenges across different time zones. And let’s not forget the significant advantages—like offering round-the-clock service, which many of our clients truly appreciate.

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Social media for accountants helps firms grow by attracting better clients. But how to make it work and where to post – LinkedIn, YouTube, or other platform? Read here

Looking to hire an offshore accounting team? Here are 5 skills that you should look for before making the decision.