22 Accounting Social Media Posts for Firms (That Aren’t Boring)

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Hiring offshore accountants in India has become increasingly popular, with many accounting firms based in the USA, UK, and Canada using it as a strategic solution to tackle capacity issues and boost profitability. If you’ve heard about the benefits of offshoring accounting services but are unsure whether it’s the right move for your accounting firm, then this blog is for you.

We will address common concerns that first-time accounting firms have when considering hiring offshore accountants.

The results are in, and the 2024 PCPS CPA Firm Top Issue Survey confirms a familiar challenge: finding qualified candidates is the biggest concern for US accounting firms. This ongoing “talent war” stems from a widening gap between available accountants and the industry’s growing needs.

Offshoring has been opted as a strategic solution by many accounting firms. If you’re considering this path to solve the capacity issue and empower your onsite team on advisory side, this blog is for you.

We’ll delve into key questions you need to ask yourself before partnering with the right offshore accounting team.

The very first concern that comes to mind, “Should I to hire offshore accountants?” This question has two aspects – Is your accounting firm ready for offshore accounting and does your firm need the support of offshore accountants.

You see, offshore accounting fits in with modern accounting firms because technology has a very big role to play when offloading your work beyond borders.

Offshoring requires a strong foundation in digital accounting and a willingness to incorporate remote work. If your business is already using cloud-based accounting software, you’re on the right track. This digital shift is essential for seamless collaboration with offshore teams.

Now coming to the ‘Need’ part – the flags indicating that it’s time to have an offshore accounting team.

Accounting firm owners facing chronic time constraints often experience several challenges:

These indicators suggest your firm’s workload may have outgrown its current capacity.

Having more workload is a good thing. It shows that your firm is growing. However, this growth shouldn’t come at the cost of burned-out employees and dissatisfied clients. When you have more work, you need more employees to handle that work efficiently.

The US accounting industry is currently facing a significant talent shortage. While the demand for skilled accountants is high, several factors contribute to the difficulty of finding qualified local talent:

I like to explain it with an analogy. Let me explain it with an analogy. Imagine you’re throwing a party and need a barbecue grill, but you don’t have one in your backyard. What do you do? You find one beyond your backyard, maybe buy or borrow it.

So, why not look beyond borders to hire skilled accounting talent? The shortage is real, and the solution is straightforward.

Maybe you already tried outsourcing some accounting tasks to free up your team. While it might have offered initial relief, now you are facing new challenges.

Outsourcing and offshore accounting are often confused, but they’re actually quite different. If outsourcing didn’t work out for you, It’s time to explore a better solution.

Accounting firms require skilled professionals, but salaries can be a significant expense, especially in competitive job markets. This can limit a firm’s ability to invest in other areas or build a buffer for unexpected costs. Late client payments, under-billing due to scope creep, cyclical workloads further add to the problem of cash flow challenges.

Offshoring key accounting tasks can be a strategic solution. By hiring a team of skilled accountants at competitive rates (thanks to cost of living and exchange rate advantage), you can significantly reduce overhead expenses and free up critical resources.

Imagine your onshore team focusing on high-value client services while a dedicated offshore team handles routine tasks like bookkeeping and data entry. This translates to improved cash flow, allowing you to reinvest in your firm’s growth, and retain top talent.

Have you ever felt there’s just too much to handle in your accounting firm, and you can’t focus on what really matters? That’s what many firm owners are experiencing with the current talent shortage in the accounting industry. Due to limited staff, owners get indulged in client deliveries. Instead of focusing on strategic development, they’re bogged down with daily tasks.

Offshoring accounting services can help by offloading routine tasks empowering firm owners and onsite accountants to channel their time and energy into strategic initiatives, like:

If you said “YES” to any of the 5 listed questions, then you need to consider offshore accounting. It is a strategic solution to all the above-listed problems stopping your accounting firm from growing and attaining better profitability.

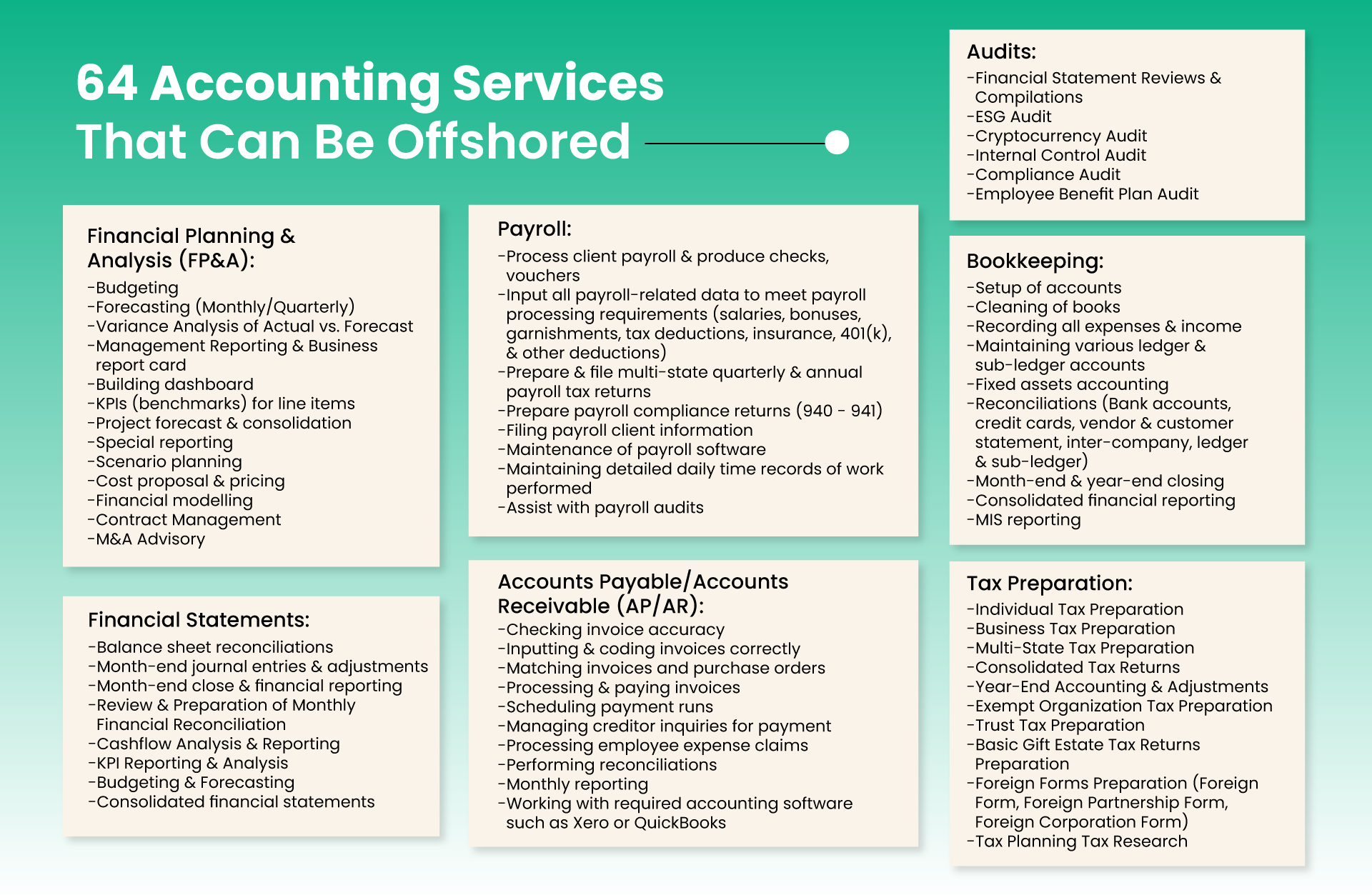

Offshoring specific accounting services can be a strategic solution, freeing up your in-house team to focus on core competencies.

But with so many options, where do you start? Here is a list of 64 accounting services that you can offshore.

As your accounting firm grows and your client list expands, so does your workload. One important question to consider when selecting an offshore staffing partner is: Can they scale with you?

With the growth of your firm, you bring in new clients, only to find your offshore accounting team stretched too thin. The benefit of offshoring – ideal staff-to-task ratio quickly disappears if your staffing partner can’t handle the increased workload. This can lead to delays, errors, and frustrated clients.

The concern about offshoring being expensive isn’t just about salaries. Several factors can impact the cost-effectiveness of your chosen approach. Accountants typically use four different staffing models for offshore accounting, each with its pros and cons. Here’s why offshoring might seem costly:

When building an offshore team through a subsidiary or hiring via a staffing agency (EOR), upfront costs can be significant. These include hiring fees, ongoing payroll management fees, and setting up an office and tech systems. If the employee isn’t a good fit, these investments can go to waste.

Quality issues and rework are common concerns when partnering with an outsourced accounting service provider.

This is where a professional offshore accounting service partner can make a difference.

Credfino combines the best of offshore and outsourced accounting, providing a dedicated and trained team that works as an extension of your onshore team—without the high hiring fees and ongoing EOR costs.

What your clients think about offshoring depends largely on how you present it. While cost-effectiveness is a major benefit, the bigger picture often involves a mix of emotions and practical considerations. Let’s dive into what your clients might be thinking about offshoring:

Some clients might still be uncomfortable with offshoring. For them, consider a segmentation approach. Target clients who are:

Based on the success stories of clients who agreed to go with offshore accounting in the pilot phase, you can convince the rest of your clients as well. It’s all about messaging.

Don’t just focus on cost savings. Position offshored accounting as a way to improve turnaround times, solution to an ongoing talent shortage and a way to gain access to a wider pool of accounting talent with specialized skills.

Choosing the right partner takes time and careful evaluation. Focus on these key factors to find an offshore accounting partner who complements your onsite team, streamlines operations, and drives growth for your accounting firm:

Look for a partner with proven experience in your specific industry.

For instance, you have a niche in providing e-commerce accounting and bookkeeping services. An offshore partner with deep experience in e-commerce understands the complexities of your clients’ businesses.

They’ll be familiar with:

Your offshore accounting staffing partner should understand the unique accounting challenges and regulations of your sector. Check for case studies or testimonials that highlight their success with similar clients.

Don’t just evaluate the company; assess the team assigned to your work. Verify their US-GAAP certifications, training, and experience relevant to your needs, whether it’s tax preparation, bookkeeping, or other services. A well-qualified team builds confidence in their ability to handle your finances.

Clear and effective communication is an important aspect especially when working with an offshore team. Evaluate how potential partners and assigned teams communicate. How’s their spoken and written English? Do they provide regular updates? Are they easily accessible for questions or clarifications? Clear and consistent communication ensures smooth operations and minimizes errors.

Also, if the communication style fits with your onsite team, you can rely on your offshore team to manage client interactions.

Your firm will evolve, so choose a partner who can scale with you. Discuss their capacity to add or remove accounting staff as your workload changes. Scalability ensures consistent service quality as you grow

Ensure the offshore partner offers clear pricing structures with no hidden fees. Understand how additional services or increased workload might affect costs.

Time zone compatibility can be one of the biggest challenge of offshore accounting. Your mornings might be the nights of your offshore team. Relying solely on asynchronous communication in offshore accounting can hinder their career progression. Limited client interaction and reduced involvement in complex, collaborative tasks can stifle their growth.

Ask you offshore partner for the solution that they are implementing to deal with the problems that come with working in different time zones

Considering the ongoing talent crunch and technology supporting remote work, offshoring is the logical solution. Consider this blog as an outline to figure out whether you are ready to go offshore, and if yes, what steps to take to ensure successful offshoring. By partnering with the right offshore accounting provider, you can:

At Credfino, we specialize in helping first-time offshoring accounting firms get the best out of offshore accounting. As Professional Offshore Accounting Services Providers, we support over 100 CPAs and accounting firms in the USA and Canada.

We believe in helping you build your own team and develop your unique culture and relationships. We handle the hiring, training, and cultural challenges of managing a team in a foreign country, so you don’t have to.

Looking to expand your team without the hassle?

Reach out to us today to learn how Credfino can help you scale your accounting firm by building remote teams.

In Digital bookkeeping, one uses software to record and manage financial transactions instead of dealing with piles of paper. It makes keeping track of invoices, receipts, and bank statements smoother, all while reducing errors. With digital tools, you get real-time updates on your finances, making it easier to see where your money is going. Plus, it’s all stored on cloud which makes it easy to access whenever you need it.

Digital accounting takes the entire accounting process online. This means using software for everything from bookkeeping and financial reporting to tax preparation and auditing. By automating routine tasks, digital accounting saves time and reduces mistakes. It also makes it easy for team members to collaborate, even if they’re not in the same location.

You can offshore a over 64 accounting tasks to save time and money. These include bookkeeping (like setting up accounts and recording expenses), tax preparation (for both individuals and businesses), and financial reporting (such as balance sheet reconciliations and cashflow analysis). Accounts payable and receivable tasks, payroll processing, and even auditing services can also be offshored.

Employer of Record (EOR) is a staffing solution where a third-party company takes care of all the employment-related tasks. This includes managing payroll, taxes, benefits, and ensuring compliance with local labor laws. Essentially, the EOR becomes the legal employer of your team, but you still manage the day-to-day work. It’s a great way to expand your team internationally without the hassle of setting up a legal entity in another country.

Namrata Jain is a Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations. She's an Enrolled Agent (EA) and Chartered Accountant (CA) and brings over 12 years of experience in accounting and taxation.

Namrata Jain is an Enrolled Agent (EA), Chartered Accountant (CA), and Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations.

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Social media for accountants helps firms grow by attracting better clients. But how to make it work and where to post – LinkedIn, YouTube, or other platform? Read here

Looking to hire an offshore accounting team? Here are 5 skills that you should look for before making the decision.