22 Accounting Social Media Posts for Firms (That Aren’t Boring)

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Challenges in the accounting industry seem never-ending. Keeping up with technology and regulations is an ongoing struggle. A few years ago, COVID hit, and accountants, like many others, had to shift to remote work overnight. Now, the big challenge is accounting staffing amid the shortage of accountants in the US.

Finding, recruiting, and keeping top accounting talent is becoming difficult every year and there’s a reason for that (discussed below). You are not alone in this situation. As per the PCPS survey, ‘finding qualified staff’ is the top concern for accounting firms of all sizes.

But the real question is why are we stuck with these accounting staffing challenges? Where did all the skilled talent go? If you’ve struggled to find skilled accounting professionals recently, you’re probably asking these questions.

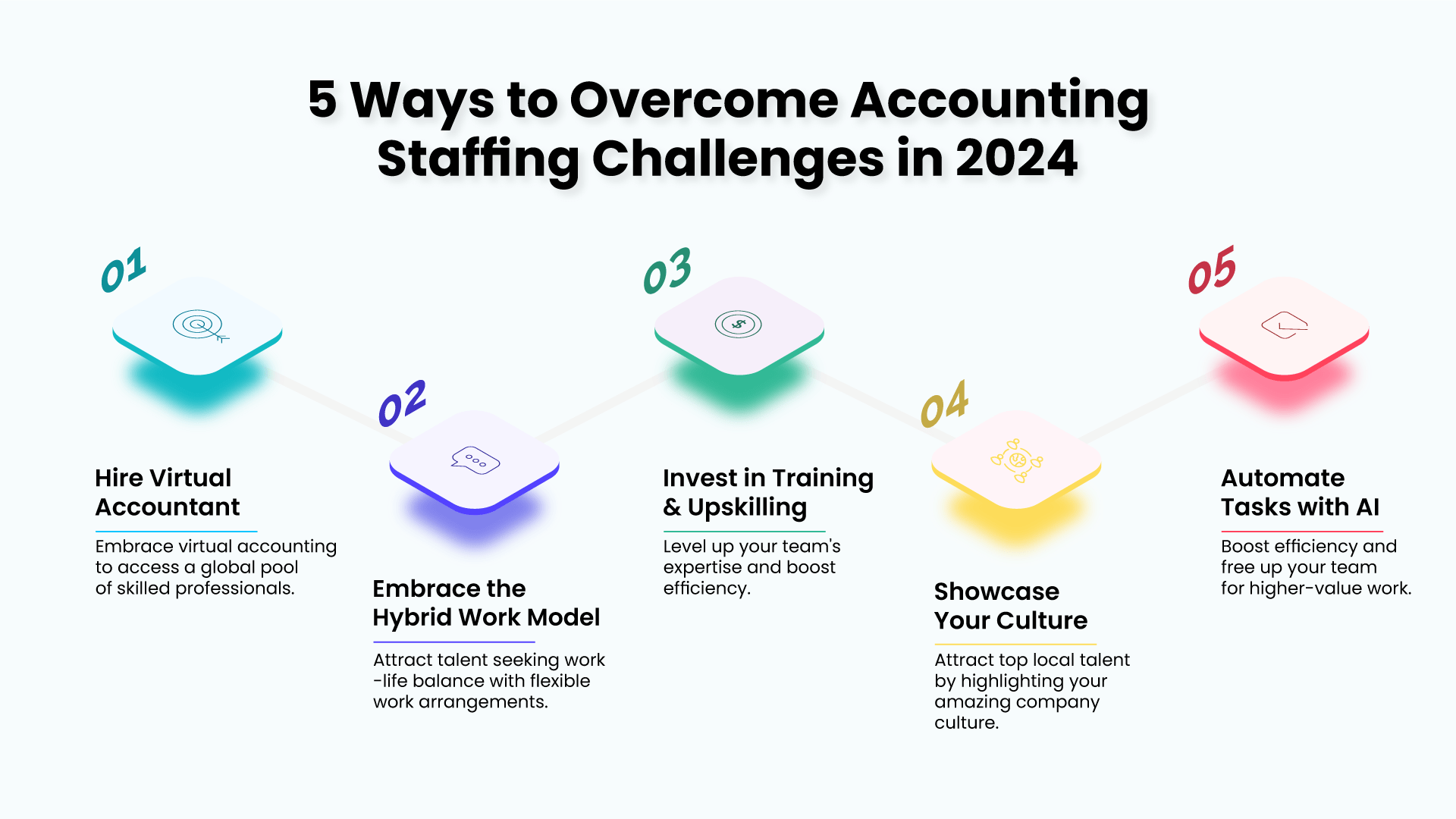

Let’s dive into what’s happening in the accounting industry and explore five ways to tackle these challenges head-on.

If you already know where all the skilled accounting talent went and why there’s a shortage in the industry, feel free to skip to the next section. It is the talk of the town. If not, stick with me here to understand the root cause of the problem before heading towards the solution.

What’s happening in the accounting industry is a classic Economics 101 scenario. There is a gap between demand and supply—demand is high, supply is low, and skilled accountants are commanding higher compensation as a result. But what’s wrong with the supply? Here’s the breakdown:

To understand the talent shortage better, we need to classify accountants and CPAs by age groups. Using common age groupings, we can categorize the accounting workforce into baby boomers, Gen X, Gen Y (popularly known as Millennials), and Gen Z.

The problem isn’t limited to just one age group; all of them are facing challenges, which is why the issue has become so significant.

Baby Boomers, born between 1946 and 1964, are currently between 57 and 75 years old. A significant portion of the highly skilled accounting workforce falls into this age group and is nearing retirement. The American Institute of Certified Public Accountants (AICPA) underscores this concern, noting, 75% of all CPAs had reached retirement age by 2019.

As these baby boomers exit the field, the industry is experiencing a natural decline in experienced professionals. This means losing valuable institutional knowledge, expertise, and client relationships that have been built over decades. While Gen X and Millennials are stepping up as experienced accountants, their numbers aren’t enough to fill the void left by retiring baby boomers. In 2020, only 25% of CPAs were left.

And the concern is not just about CPAs. Looking at the current workforce, Zippia’s data reveals a troubling gap:

The statistics don’t look good for the upcoming times as well.

The accounting industry is leaning heavily on Gen X and Millennial professionals to fill the gap left by retiring baby boomers. However, there’s a troubling trend—many talented accountants from these generations are leaving the field altogether.

The main reason? Work-life balance struggles. Long hours, demanding deadlines, and constant pressure can create significant strain. This “burnout” can lead to:

As Baby Boomers retire, the question arises: who will fill their shoes? The expected new players are Gen Z, but there’s a problem—Gen Z is not flocking to accounting as a profession.

According to a recent report by Accounting Today, data from the National Association of State Boards of Accountancy shows that the number of people taking the CPA exam dropped by almost 50% between 1990 and 2021.

Enrollment in accounting programs is also decreasing, and here are a few reasons why:

This issue has caught the attention of the AICPA, leading them to create the NPAG committee to address the talent pipeline problem. You can read more about the NPAG’s initiatives [here].

New graduates entering the accounting field are increasingly demanding higher starting salaries. This isn’t necessarily an unreasonable expectation.

In a recent webinar by Accounting Today “Winning the War for Talent”, the discussion held center stage. “Starting salaries in accounting are not competitive with other majors and do not keep pace with inflation. A serious salary study is essential, considering not just competitors but also other business majors.” – Kristin Murray, Managing Shareholder at Weinstein Spira

Not only are new graduates pushing for higher starting salaries, but they also want more benefits.

The talent shortage in accounting is pushing firms to get creative. When you can’t find what you need locally, you look elsewhere. In this case, “elsewhere” means tapping into the global talent pool.

Digital accounting tools like QuickBooks and Xero have revolutionized the way we work, making virtual accounting possible. This means you’re no longer limited to hiring accountants in your physical location. Virtual accounting lets you cast a wider net, allowing you to consider qualified accountants from anywhere in the world.

This significantly expands your pool of potential candidates, giving you the freedom to find the perfect fit for your needs, regardless of their location. This approach, known as offshoring, offers various staffing models to address the accounting talent shortage effectively.

Additional Benefits of Offshoring and Virtual Accounting for Accounting Firms

The flexibility of remote work is a major draw for top talent in today’s job market. By offering remote options, you make your firm more appealing to accountants seeking a healthy work-life balance. Remote work eliminates geographical barriers, allowing you to hire talented accountants from different states, bringing a wider range of experience and perspectives.

Remote hiring opens doors to talent with specialized skills that might not be readily available locally, helping you build a more diverse and skilled team. Compete on a global scale for top talent and offer a desirable work-life balance that attracts top performers.

This approach increases employee satisfaction and reduces turnover, leading to a stronger team and solves accounting staffing issues for you but the problem stays the same on macro level.

Expecting a team of 10 to handle the workload of 20 is neither reasonable nor sustainable. Over time, this approach leads to employee burnout. However, investing in the training and upskilling of those 10 employees can make them capable of performing the work of 20. By training them on new technologies, processes, and best practices, you can equip your existing team to manage a larger workload more efficiently.

While it may not be a perfect solution, it is a viable short-term strategy to address accounting staffing issues. Employees will also appreciate the opportunity for upskilling, as it provides them with chances for growth and development. This not only enhances their skills but also boosts their job satisfaction and engagement.

Investing in your employees’ growth through training shows that you value them and their careers. This can lead to increased job satisfaction, reduced turnover, and a more loyal workforce.

Key Training Areas for Improved Efficiency in Accounting

However, there is a limit to how much additional work an upskilled team can handle, so be mindful not to overload them to avoid burnout.

The accounting industry suffers from an image problem, as Logan Graf suggests. This “branding problem” discourages young talent from entering the field.

But showing the amazing culture is not just about attracting new talent but attracting the existing one in your accounting firm. Remember, it’s a talent war and you’re fighting for top talent with other accounting firms. How will you win? By saying that you are the best accounting firm to work for.

In today’s competitive market, top talent seeks more than just a paycheck. They prioritize company culture. By showcasing a positive and supportive work environment through social media like LinkedIn and Twitter, accounting firms can demonstrate they’re not just about numbers – they offer a fun, engaging, and rewarding work experience that top talent will want to be a part of. This strategy, along with highlighting your expertise and mentorship opportunities, can position your firm as the employer of choice in the current talent war.

In the webinar, Kristin Murray highlighted the culture at her firm, emphasizing the importance of avoiding micromanagement, offering flexibility, and ensuring employees don’t feel overburdened. Accountants considering a job change are likely to prefer her firm over others that haven’t publicly addressed these issues.

Key things to do showcase your amazing culture

By automating repetitive tasks such as data entry, reconciliation, and simple invoice processing, AI tools like ChatGPT can greatly reduce your team’s workload. Identify additional areas where automation can be applied to streamline processes. This allows your team to focus on higher-value activities like financial analysis, client communication, and strategic planning.

Tip – Jason Staats covers various use cases of AI in accounting.

Also Read – Top 10 AI Accounting Software in 2024

The accounting industry is currently facing a perfect storm of talent challenges. Retiring baby boomers, overworked professionals seeking better work-life balance, and a shrinking pipeline of young talent all contribute to this significant issue. However, this crisis also offers an opportunity for forward-thinking firms.

While demographics play a role, the real issue is burnout. Accounting firms must prioritize creating a culture that fosters both professional growth and work-life balance. This approach will not only attract new talent but also retain existing employees who seek a sustainable career path.

To address the talent shortage effectively, some serious shifts are necessary. Virtual Accounting and Offshore Accounting are logical solutions. Based on the numbers discussed, it’s clear that the Gen X and Millennial workforce might fall short. While the NPAG is working on the talent pipeline, preparing Gen Z to take over will take a few years due to the demanding nature of CPA certification.

Technology provides much-needed support to make these accounting staffing models work. By virtual accounting teams, firms can tap into a global talent pool. Investing in training for automation tools like AI can also free up valuable human capital for higher-value tasks such as strategic analysis and client communication.

By adopting AI and virtual accounting, firms can navigate the current talent shortage and build a more adaptable, future-proof workforce.

Credfino has assisted over 100 CPAs and accounting firms in identifying their specific needs and resolving ongoing capacity issues.

At Credfino, we offer a skilled and diverse virtual bookkeeping and accounting team, providing continuous support and consultation for niche specialization, marketing for accountants, and much more.

Schedule a call to know how Credfino can help your accounting firm.

Offshoring and virtual accounting allow you to tap into a global talent pool, giving you access to skilled accountants regardless of location. This significantly expands your options and helps you find the perfect fit for your needs.

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Social media for accountants helps firms grow by attracting better clients. But how to make it work and where to post – LinkedIn, YouTube, or other platform? Read here

Looking to hire an offshore accounting team? Here are 5 skills that you should look for before making the decision.