Why Tiered Pricing Strategy is a must for Accounting Firms (+Template Inside)

Tiered pricing gives accounting firms a flexible, confident way to price their services and raise fees without fear. Template included.

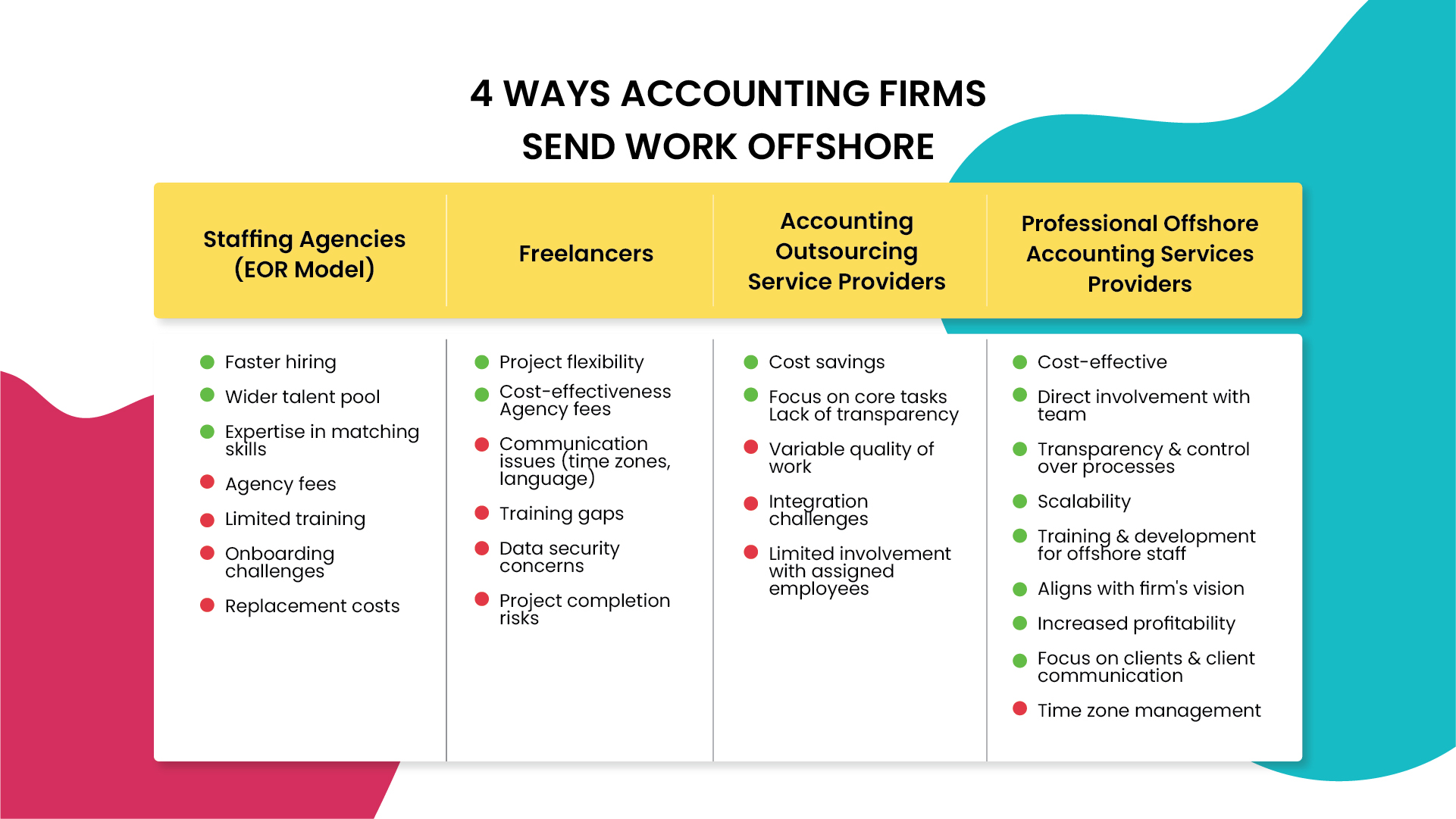

Accounting firms are getting inclined towards outsourced bookkeeping services and offshore accounting to handle their workload. And there is not one way, but 4 models that accounting firms can choose from to fill the talent gap.

With the industry facing capacity issues, especially during tax season, many accountants are experiencing a disrupted work-life balance. The excessive workload amid a shortage of accountants in the country leads to dissatisfied employees. Accounting firms struggle with retaining top talent. To manage the high volume of work, firms are adopting automation and offshoring strategies.

Offshoring and automation can’t fully replace onshore accountants, but they are effective strategies to manage staff shortages. These approaches let your onshore team focus on core tasks.

Offshore accounting offers many benefits, but to maximize them, you need to choose the right staffing model for your firm. Understanding the differences between these models is crucial.

In this blog, we will discuss four offshore accounting staffing models and explore the pros and cons of each.

When you hire onshore, you can either recruit directly or take the help of a recruitment agency to find a suitable candidate. Similarly, when you offshore accounting, staffing agencies help you with global recruitment but also handle local labor laws, employment regulations, payment, and payroll.

Staffing agencies in the accounting industry recruit and vet candidates from countries like India, the Philippines, and Latin America. They take care of payroll, which is why they are also known as Employer of Record (EOR).

They handle the initial screening and recommend candidates who meet your needs. This model helps firms quickly fill positions with qualified personnel without dealing with international hiring complexities. Payment can be a one-time fee or recurring management fees, depending on the agreement.

Freelancers offer offshore accounting services on a project-by-project basis through platforms like Fiverr. The hiring process is simple: identify a talent gap, search for the service on the platform, place your order, complete the payment, and you’re done.

The main challenge with freelance offshore accounting is vetting the candidate. This model provides firms with the flexibility to scale their workforce up or down as needed without long-term commitments. However, firms must manage quality control and project consistency, as freelancers work independently.

Outsourcing involves delegating entire projects or operations to a third-party service provider. This eliminates the need for direct employment, as the outsourcing partner manages all aspects of project execution.

It’s beneficial for handling large volumes of work or specialized tasks without expanding your internal workforce. The main challenge is maintaining control over the process and aligning outsourced work with your firm’s standards. Often in accounting outsourcing, accounting firms don’t get to work directly with employees.

With this form of staffing model of offshore accounting, you work with a service provider that assigns a dedicated team to work closely with your firm. Professional Offshore Accounting Service Partner brings the best of offshore accounting and outsourced accounting together. You get an integrated team working as an extension to your onshore team that too without paying hiring fees and ongoing EOR fees.

It is the most cost-efficient way to hire top offshore accounting talent, aligning with your processes and culture. The service provider handles recruitment, payroll, and training. This is ideal for firms seeking a consistent, integrated team while enjoying cost savings and access to a broader talent pool.

Offshore accounting, where professionals outside the firm’s home country deliver services, is gaining popularity due to several benefits.

Offshore teams help manage workloads, especially during peak periods like tax season. They handle overflow work, reducing pressure on local accountants and ensuring tasks are completed on time, improving overall efficiency.

Hiring local accountants can be expensive, particularly in high-demand areas. Offshore staffing offers access to skilled professionals at lower costs. This approach reduces overhead costs for office space, benefits, and payroll taxes compared to local hiring.

Offshore locations often have accountants with specific skill sets, such as international tax compliance. Professional Offshore accounting service-providing companies ensure that their accountants are US GAAP trained.

Offshore teams can take over repetitive tasks like data entry and bookkeeping, freeing up local staff to focus on higher-value activities. This reduces stress and burnout, leading to a more positive work environment and lower employee turnover.

Global Staffing solution providers in offshore accounting are essentially matchmakers between accounting firms looking to offshore and potential employees. They specialize in searching for qualified remote accountants who are bookkeepers based on the firm’s specific needs. Staffing agencies find, vet and conduct initial interviews with the candidate. The final list of candidates is given to the accounting firm and they make the final decision.

The EOR model (Employer of Record) is a common setup with recruitment agencies. Here’s the breakdown:

Recruitment agencies charge fees that vary based on the agency, position, and candidate’s salary. Common fee structures include contingency (paid upon successful hire), retained (upfront payment), and fixed fee (set fee regardless of outcome).

Usually, flat fee (around $4,000 for single direct hire) is charged excluding the ongoing EOR fees.

You need a staff accountant with tax prep experience, so you contact a recruitment agency. They find and screen three candidates, then present the top two. You hire one, noting a training gap you’ll address. Months later, you realize the new hire lacks the necessary attention to detail. In this scenario, you would need to go back to the agency to start the search process again, potentially incurring additional fees

Offshore freelance accountants are independent professionals residing outside your country’s borders who can offer accounting services like bookkeeping, data entry, or tax preparation remotely. You typically find them through online platforms such as Fiverr or by contacting offshore outsourcing companies specializing in accounting tasks.

Project-Based Flexibility: Freelancers are ideal for short-term projects like tax season backlog, offering scalability without long-term commitment.

Under this staffing model, accounting firms hire a third-party company to handle specific accounting tasks for a set fee. Outsourced accounting is perfect for small, non-core projects that don’t need ongoing in-house expertise. These are usually repetitive, time-consuming tasks.

List of most common outsourced services in accounting industry:

Cost-Effectiveness: Outsourcing small projects saves money compared to hiring full-time staff, avoiding salaries, benefits, and office space costs.

Partnering with professional offshore service providers combines the best of outsourcing and offshoring. Traditional outsourcing involves hiring a third party for daily operations but lacks transparency and direct interaction with employees, making it ideal for short-term projects.

On the other hand, offshoring with the Employer of Record (EOR) model allows direct work with employees but is not as cost-effective due to initial fees, training costs, and ongoing EOR expenses.

Professional offshore service providers blend the simplicity and cost-effectiveness of outsourced accounting with the transparency and direct involvement of offshore accounting, offering an optimal solution for accounting firms.

This cost-effective approach helps CPAs save money while maintaining control over their standard procedures and accessing real-time data as they get to work directly with employees, which is crucial for strategic decision-making for end-clients.

Time Zones: Managing teams across different time zones requires careful coordination

The growing popularity of offshore accounting offers a win-win situation for accounting firms. It allows them to address talent shortages, reduce costs, and improve efficiency. However, maximizing these benefits hinges on selecting the most suitable staffing model for your specific needs.

Consider your firm’s size, workload, budget, and desired level of control when making your decision.

For short-term projects or specialized tasks: Freelancers or outsourcing companies might be suitable.

For ongoing needs and cost-effectiveness: Professional offshore accounting service providers offer a compelling solution.

Remember key points when choosing staffing model for offshore accounting…

At Credfino, we have created a sweet spot for accounting firms to get the best of offshore accounting. We are Professional Offshore Accounting Services Providers and helping over 100 CPAs and accounting firms in USA and Canada.

We believe in helping you build your own team and develop your unique culture and relationships. We also want to save you the trouble of hiring and training someone in a foreign country and dealing with cultural differences. That’s why we take care of these challenges for you.

Interested in expanding your team without the hassle? Reach out to us today to learn how Credfino can help you scale your accounting firm by building remote teams.

Offshore staffing refers to the practice of hiring or contracting with professionals located in a different country to perform work for your company. In the context of accounting, this means utilizing skilled accountants outside your home country to handle various accounting tasks.

The cost structure varies depending on the model you choose:

1. Staffing Agencies (EOR Model):

Recruitment Fees: Can be a one-time fee or recurring management fees depending on the agreement. Flat fees typically range around $4,000 for a single hire, excluding ongoing Employer of Record (EOR) fees.

EOR Fees: The agency handles payroll, taxes, and benefits, incurring additional costs on top of the recruitment fees.

2. Freelancers:

Project-based Rates: Freelancers set their own rates, which can vary depending on experience and project complexity. Platforms like Fiverr might have additional service fees.

3. Accounting Outsourcing Service Providers:

Fixed Fee: Providers typically charge a fixed fee per task or project, offering cost predictability.

4. Professional Offshore Accounting Services Providers:

This model often involves a monthly fee based on the service you are asking for or the dedicated team size. This can be more cost-effective than in-house staff but might be slightly higher than basic outsourcing.

Yes, they can! Offshore accountants have expertise in many areas beyond basic tasks. They can handle tax advisory, financial reporting, and making financial recommendations. The complexity of tasks that an accountant can handle depends on the accountant’s seniority and experience. In countries like India, you can find highly qualified chartered accountants and enrolled agents ready to support CPAs.

Namrata Jain is a Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations. She's an Enrolled Agent (EA) and Chartered Accountant (CA) and brings over 12 years of experience in accounting and taxation.

Namrata Jain is an Enrolled Agent (EA), Chartered Accountant (CA), and Partner at Credfino, focusing on Tax for both Canadian and U.S. clients, including individuals and corporations.

Tiered pricing gives accounting firms a flexible, confident way to price their services and raise fees without fear. Template included.

Offshore accounting is here to stay. The question is how it is affecting the accounting industry. This is a debate that matters.

No accountant wants to train AI and ML models. Yet, AI in accounting can’t be ignored. Learn how to use accounting AI without being technical.