22 Accounting Social Media Posts for Firms (That Aren’t Boring)

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

The acronym CAS Accounting can mean different things depending on the context. In the realm of remote work, it often refers to Cloud Accounting Software. In traditional accounting, it’s typically about Client Accounting Services. But today, we’re focusing on modern accounting—where you work less and earn more, and where accountants do so much more than just crunch numbers. I’m talking about Client Advisory Services.

Think of this blog as your first step into the world of accounting advisory services.

We’ll cover:

Let’s dive in

CAS—Client Advisory Services—are exactly what the name suggests: they provide valuable accounting advisory services to your clients. These advisory services can cover a wide range of topics, from expansion and cash flow to hiring strategies. If a business owner (a.k.a. your client) trusts you to guide them in growing revenue and maximizing efficiency, then you’re already delivering CAS Accounting.

At its core, Client Advisory Services (CAS) is all about:

CAS is a future-focused service where you provide valuable advice to your clients based on real-time data. This proactive approach empowers them to make informed decisions and seize opportunities for growth.

Related Read – Accounting Advisory is the missing piece in growing your firm revenue

Chances are, you’re already offering these advisory services. But the real question is: are you charging for them, or are you leaving money on the table?

The most fundamental service small businesses receive from an outsourced accountant includes cleaning up their books, preparing year-end financial reports, and filing taxes. Since accountants already understand the numbers inside and out, they hold a unique advantage in offering valuable financial advice. In fact, clients often seek out friendly advice during these discussions.

Moreover, those casual conversations carry significant value. Therefore, you can package them with your compliance services and effectively upsell your advisory services.

Ready to transition your firm from a compliance-focused model to one that combines both advisory and compliance services? Let’s chat!

While making the shift, ensure you’re capturing the value you truly deserve! And that begins with understanding the difference.

Compliance accounting is a mandatory service for business owners. By outsourcing tasks like maintaining their books to experts, they can free up valuable time to focus on growing their business. Compliance is the need – service that your clients have to avail themselves of due to government mandates.

Consulting and Advisory Accounting fall into the ‘want’ category. Your clients ‘want’ to make the best financial decision.

For example, let’s say one of your clients approaches you with a one-time project for profitability analysis and cash flow projections before opening another restaurant branch. They want to evaluate whether the current branch can support the expansion and estimate the startup costs and operating expenses of the new location. This type of project falls under consulting.

Now, if the same client requests a monthly or quarterly call for ongoing financial advice, that transitions into what we call advisory accounting.

Understanding these distinctions will help you provide the right services tailored to your clients’ needs!

KEY DIFFERENCES

Compliance Accounting

Consulting Accounting

Advisory Accounting

There’s a lot of buzz in the accounting industry about the claim that compliance is dead. Every day, we hear about the latest advancements in AI, like using ChatGPT to draft Chart of Accounts, or tools that automate accounts payable and receivable.

While these innovations are significant, they’re not the main reason for the shift toward accounting advisory services.

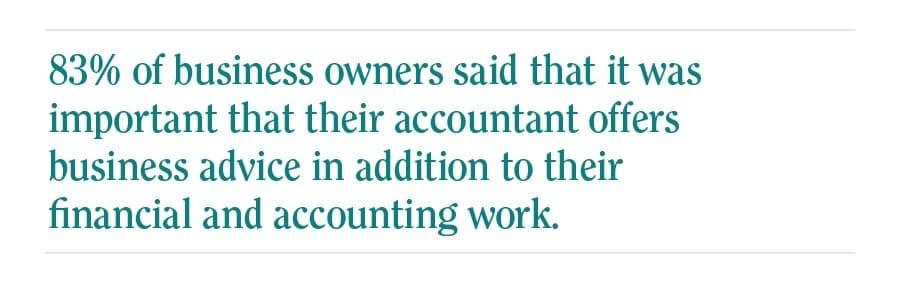

Client Accounting Services (CAS) creates a win-win situation for both clients (business owners) and firm owners. It’s essential to understand the benefits for each party.

Why does this matter?

For your firm, understanding what you might be missing out on can unlock new opportunities. Understanding the benefits for your clients will help you frame effective messaging for upselling and marketing your advisory services.

Benefits for your Firm

Accounting advisory is higher value work bringing more revenue. We have already talked about that. But the benefits for your firm go beyond that.

As tax season approaches, tax firms are gearing up for the upcoming roller coaster ride. I’ve noticed many firm owners complaining about the intense workload during a few months of the season, followed by minimal work the rest of the year. If you’re one of those firm owners seeking stability and a consistent flow of work, then CAS Accounting is your solution.

If you’re only offering compliance services, it can be challenging to differentiate your offerings. You might work on communication, delivery, and accuracy, but at the end of the day, your services become productized. In contrast, advisory services focus on strategic moves that can save your clients significant amounts of money, helping you stand out from your competition.

The talent shortage in the accounting industry is no secret. Firms are automating and offshoring their operations to stay competitive. If you want to keep work onsite, having advisory services in your repertoire can be a game-changer. The best part? This type of service is not heavily reliant on talent.

Benefits for your Clients

While compliance is essential, advisory services open the door to significant savings. Clients don’t just need to meet regulations; they want to maximize their financial potential through strategic advice.

With advisory services, clients gain a constant financial ally. This trusted advisor is there to support them in making crucial business decisions, ensuring they have the guidance needed to navigate challenges and seize opportunities.

Tax planning optimizes your clients’ tax liabilities and maximizes deductions, ultimately minimizing their tax burdens and increasing profitability. By proactively managing tax strategies, you ensure they keep more of their hard-earned money.

Monthly management reporting provides real-time insights into financial performance, helping clients identify trends, opportunities, and potential risks. By offering data-driven analysis, you empower them to make informed decisions for effective business management. This service establishes your role as a trusted advisor, guiding clients toward better financial outcomes and improved operational efficiency.

Cash flow analysis enhances clients’ cash management and liquidity by identifying potential shortages and developing strategies to address them. This service helps optimize working capital and improve financial stability. By assisting clients in maintaining healthy cash flow, you demonstrate your commitment to their long-term success, making you an invaluable resource in their financial journey.

Budgeting and forecasting enable clients to create accurate financial projections and budgets, assessing the financial impact of their business decisions. By helping them plan for future growth and expansion, you position yourself as a strategic partner who understands their goals. This service enhances your advisory capabilities and strengthens client relationships by providing clarity and direction.

Business planning involves developing comprehensive plans for new ventures or existing operations, setting clear goals, and crafting strategies for achieving objectives. By assessing market opportunities and risks, you provide clients with a roadmap for success. This service is essential in advisory roles, showcasing your expertise and commitment to helping clients thrive in a competitive landscape.

Exit planning develops a strategic approach for clients looking to sell or transition ownership of their business. This service optimizes tax implications and maximizes returns, ensuring a smooth and successful transition. By guiding clients through this critical phase, you reinforce your value as an advisor and help them secure their financial future, making it a key offering in your advisory services.

Looking for the perfect partner to help you navigate the change? Let’s connect

CAS creates a win-win situation for both clients and firm owners. For firms, advisory services lead to year-round work, differentiate them from competitors, and are less affected by talent shortages. For clients, these services unlock significant savings and provide a reliable financial ally for decision-making.

If you want to increase profitability and get ahead of competitors, then you must consider CAS Accounting services. The accounting advisory services that you can offer depend on your expertise and the clientele.

If you have a good number of tax prep clients then adding tax planning to the mixture is a smart move. Similarly, depending on the client’s requirements, you can plan a service package.

Credfino is an offshore staffing partner for accounting and tax firms based in the US and Canada. But our service suite is not limited to that. We also help firms transition into modern accounting firm by upgrading tech stack, fixing pricing models, and also navigating from compliance to advisory.

Schedule a call to learn how we can help you in building the firm of your dreams.

CAS stands for Client Accounting Services. This approach focuses on providing a range of accounting services tailored to client needs. It goes beyond traditional compliance tasks, emphasizing proactive advice and support. By understanding clients’ unique challenges, firms can deliver value that strengthens relationships and drives business growth.

Advisory Accounting involves offering strategic advice and insights to clients, helping them make informed financial decisions. This service encompasses areas such as financial planning, budgeting, and risk management. By focusing on clients’ long-term goals, advisory accountants position themselves as trusted partners, enhancing the overall value of their services.

Absolutely! Accounting and advisory services complement each other seamlessly. While traditional accounting focuses on compliance and reporting, advisory services provide strategic insights and recommendations. By integrating both, firms can deliver comprehensive solutions that address immediate needs and long-term objectives, ultimately driving greater client satisfaction and business success.

Key benefits of CAS for accounting firms include enhanced client relationships, increased revenue opportunities, and improved decision-making. By providing tailored solutions, firms position themselves as trusted advisors, fostering loyalty and trust. Additionally, CAS enables firms to differentiate themselves in the market, creating a competitive edge and driving growth.

Still posting boring “get your books done” posts for marketing for CPA firm? STOP. Get inspiration for accounting social media posts that work + post angle inside

Social media for accountants helps firms grow by attracting better clients. But how to make it work and where to post – LinkedIn, YouTube, or other platform? Read here

Looking to hire an offshore accounting team? Here are 5 skills that you should look for before making the decision.